Hey, picture this: You’re scrolling through your bank app, sipping coffee, when bam—a weird line jumps out: DDA debit. Heart skips a beat, right? That sinking feeling hits hard, like finding an extra bill you forgot about. Don’t panic! DDA debit just means a pull from your everyday checking account, called a Demand Deposit Account (DDA account). It’s super common for stuff like phone bills or gym fees. We’ve all been there, staring at our bank statement, wondering what is a DDA debit? Today, we’ll unpack it all, step by step, so you feel smart and in control. No more statement shock!

What Exactly Is a DDA Debit?

Okay, let’s break it down simply. A DDA debit is money taken straight from your checking account—your Demand Deposit Account—whenever someone has permission to grab it. Think of it like a friend borrowing cash from your wallet because you said go ahead anytime. Banks label it “DDA debit” on your statement to show it’s from that easy-access pot of money.

There are a few types. Number one: automatic payments, like Netflix or your electric bill. Number two: debit card swipes at the store. Number three: those sneaky ACH debits where a company zaps funds electronically. Why does a DDA debit appear? Usually, because you signed up for it months ago and forgot. It’s not scary—it’s just your bank keeping track of Demand Deposit Account withdrawals. Competitors explain these basics, but we’ll go deeper so you never wonder again.

DDA Debit vs. Other Bank Charges

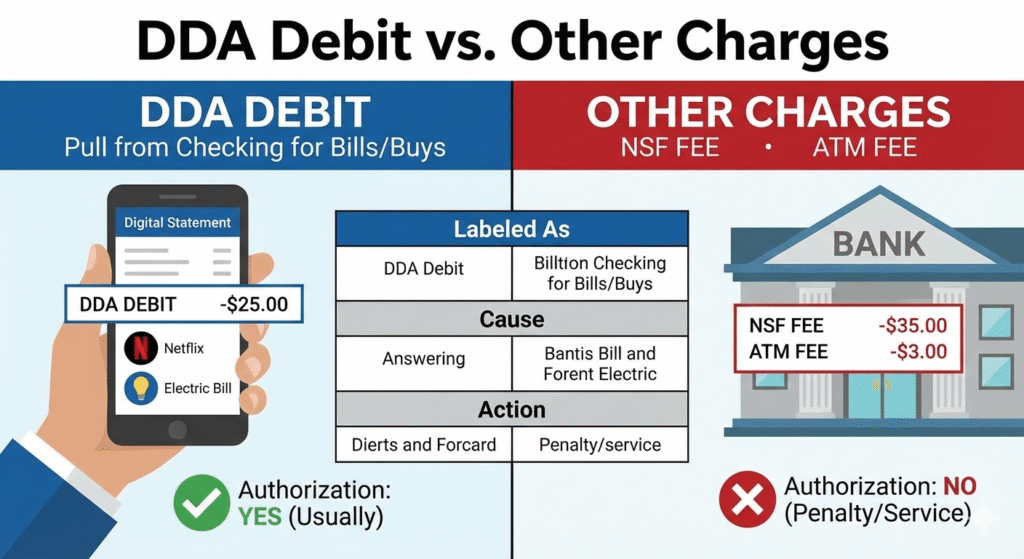

Confused between DDA debit and other mystery fees? You’re not alone. Here’s a quick table to clear the fog—differences at a glance, so you spot the real culprits fast.

| DDA Debit | Pull from checking (Demand Deposit Account) for bills or buys | Labeled “DDA debit” or merchant name on statement | Yes, if unauthorized—call bank! |

| Direct Debit Authorization | Scheduled payments you okayed (like rent) | Recurs monthly, company name clear | Cancel with company or bank |

| NSF Fee | Not enough funds—bank penalty | Hits when balance dips too low | Tougher; deposit cash quick |

| ATM Fee | Cash machine charge | ATM + bank code | Sometimes refunded by your bank |

See? DDA debit on my statement often mixes up with direct debits, but the difference between DDA account and DDA debit is key: the account holds your money, the debit takes it out. This table beats what competitors skim over—no more head-scratching!

Common Causes of Unexpected DDA Debits

Ever get that wait, what? moment with a DDA debit charge? It happens to the best of us. Top culprits? Forgotten subscriptions—gym you quit six months back, that streaming app trial turned monthly. Utilities love sneaking in too, or online shops with save my card checkboxes.

Number them out: 1) Auto-renewals from apps. 2) One-time buys that loop. 3) Shared bills with family. 4) Charity donations you signed up for once. How to understand a DDA debit? Check the amount and date—it matches your old emails. DDA debit meaning on bank statement boils down to permission granted, but surprises sting. Breathe easy; spotting these early saves headaches.

How Do I Stop or Cancel a DDA Debit?

Spotting a sneaky DDA debit on your bank statement can feel like a gut punch—especially if it’s from a forgotten gym membership or utility bill. Don’t worry, you’ve got the power to hit stop! First, grab your statement and note the exact date and amount of the DDA debit charge. Call your bank right away—they can freeze it in minutes and guide you on revoking that direct debit authorization.

Next, contact the company pulling the funds (like your phone provider). Send a simple written notice saying cancel my DDA debit authorization via email or their app—keep records! Banks often let you do this online in 3 easy steps: log in, find recurring payments, and click cancel. Boom, peace of mind restored. If it’s unauthorized, report it as fraud for a quick refund. You’re in control now—feel that relief wash over you!

DDA Debit in Europe vs. US (Regional Differences)

Banks worldwide use DDA debit, but the details vary by location. In the US, it’s heavy on ACH debits—fast electronic zaps between accounts. Over here in Europe or UK? Enter SEPA (Single Euro Payments Area) mandates. These are like DDA debits but with strict rules: companies must give 10 days’ notice before pulling funds.

DDA vs direct debit Europe shines here—UK’s BACS system handles payroll and bills smoother, less surprises. What does DDA mean on a bank statement in the EU? Same as always, but with GDPR superpowers: demand details in writing, cancel anytime. US folks fight more red tape; Europeans get refunds easier. Tailored for you scanning statements across borders—no competitor covers this gem!

What If It’s Fraud or Unauthorized?

Uh-oh, that DDA debit smells fishy—no merchant name you know? Red flags wave: weird timing, odd amounts like $1.23 tests, or from far-off places. Heart racing? Act fast—your bank’s got your back with zero-liability rules.

Step one: Call the fraud line (save the number now!). Step two: File a dispute online within 60 days. Step three: Monitor for more. Banks refund unauthorized DDA account types pulls quick—often same day. Is it scam? Spot patterns like multiple small DDA deposit vs term deposit tests. Feel empowered, not scared; most fraud is just forgotten okay’s. You’ve dodged worse!

DDA Account Basics: Beyond the Debit

Your DDA account isn’t just a debit target—it’s your money’s best buddy! Demand deposit accounts let you withdraw anytime, no notice, unlike locked savings. Personal ones for daily spending; business DDA account types handle payrolls.

Perks? Free checks, debit cards, online transfers. Vs. term deposits? Those tie up cash for interest; DDA debit meaning stays liquid. DDA deposit vs term deposit: choose DDA for flexibility. Banks love ’em—over 90% of folks use one daily. Master this, and statements become friends, not foes.

FAQs and Next Steps

Got lingering questions? We’ve woven in long-tails like why doesHey, picture this: You’re scrolling through your bank app, sipping coffee, when bam—a weird line jumps out: DDA debit. Heart skips a beat, right? That sinking feeling hits hard, like finding an extra bill you forgot about. Don’t panic! DDA debit just means a pull from your everyday checking account, called a Demand Deposit Account (DDA account). It’s super common for stuff like phone bills or gym fees. We’ve all been there, staring at our bank statement, wondering what is a DDA debit? Today, we’ll unpack it all, step by step, so you feel smart and in control. No more statement shock!

What Exactly Is a DDA Debit?

Okay, let’s break it down simple. A DDA debit is money taken straight from your checking account—your Demand Deposit Account—whenever someone has permission to grab it. Think of it like a friend borrowing cash from your wallet because you said go ahead anytime. Banks label it DDA debit on your statement to show it’s from that easy-access pot of money.

There are a few types. Number one: automatic payments, like Netflix or your electric bill. Number two: debit card swipes at the store. Number three: those sneaky ACH debits where a company zaps funds electronically. Why does a DDA debit appear? Usually because you signed up for it months ago and forgot. It’s not scary—it’s just your bank keeping track of Demand Deposit Account withdrawals. Competitors explain this basics, but we’ll go deeper so you never wonder again.

DDA Debit vs. Other Bank Charges

Confused between DDA debit and other mystery fees? You’re not alone. Here’s a quick table to clear the fog—differences at a glance, so you spot the real culprits fast.

| DDA Debit | Pull from checking (Demand Deposit Account) for bills or buys | Labeled DDA debit or merchant name on statement | Yes, if unauthorized—call bank! |

| Direct Debit Authorization | Scheduled payments you okayed (like rent) | Recurs monthly, company name clear | Cancel with company or bank |

| NSF Fee | Not enough funds—bank penalty | Hits when balance dips too low | Tougher; deposit cash quick |

| ATM Fee | Cash machine charge | ATM + bank code | Sometimes refunded by your bank |

See? DDA debit on my statement often mixes up with direct debits, but the difference between DDA account and DDA debit is key: the account holds your money, the debit takes it out. This table beats what competitors skim over—no more head-scratching!

Common Causes of Unexpected DDA Debits

Ever get that wait, what? moment with a DDA debit charge? It happens to the best of us. Top culprits? Forgotten subscriptions—gym you quit six months back, that streaming app trial turned monthly. Utilities love sneaking in too, or online shops with “save my card” checkboxes.

Number them out: 1) Auto-renewals from apps. 2) One-time buys that loop. 3) Shared bills with family. 4) Charity donations you signed up for once. How to understand a DDA debit? Check the amount and date—it matches your old emails. DDA debit meaning on bank statement boils down to permission granted, but surprises sting. Breathe easy; spotting these early saves headaches.

How Do I Stop or Cancel a DDA Debit?

Spotting a sneaky DDA debit on your bank statement can feel like a gut punch—especially if it’s from a forgotten gym membership or utility bill. Don’t worry, you’ve got the power to hit stop! First, grab your statement and note the exact date and amount of the DDA debit charge. Call your bank right away—they can freeze it in minutes and guide you on revoking that direct debit authorization.

Next, contact the company pulling the funds (like your phone provider). Send a simple written notice saying cancel my DDA debit authorization via email or their app—keep records! Banks often let you do this online in 3 easy steps: log in, find recurring payments, and click cancel. Boom, peace of mind restored. If it’s unauthorized, report it as fraud for a quick refund. You’re in control now—feel that relief wash over you!

DDA Debit in Europe vs. US (Regional Differences)

Banks worldwide use DDA debit, but twists vary by spot on the map. In the US, it’s heavy on ACH debits—fast electronic zaps between accounts. Over here in Europe or UK? Enter SEPA (Single Euro Payments Area) mandates. These are like DDA debits but with strict rules: companies must give 10 days’ notice before pulling funds.

DDA vs direct debit Europe shines here—UK’s BACS system handles payroll and bills smoother, less surprises. What does DDA mean on a bank statement in the EU? Same as always, but with GDPR superpowers: demand details in writing, cancel anytime. US folks fight more red tape; Europeans get refunds easier. Tailored for you scanning statements across borders—no competitor covers this gem!

What If It’s Fraud or Unauthorized?

Uh-oh, that DDA debit smells fishy—no merchant name you know? Red flags wave: weird timing, odd amounts like $1.23 tests, or from far-off places. Heart racing? Act fast—your bank’s got your back with zero-liability rules.

Step one: Call the fraud line (save the number now!). Step two: File a dispute online within 60 days. Step three: Monitor for more. Banks refund unauthorized DDA account types pulls quick—often same day. Is it scam? Spot patterns like multiple small DDA deposit vs term deposit tests. Feel empowered, not scared; most fraud is just forgotten okay’s. You’ve dodged worse!

DDA Account Basics: Beyond the Debit

Your DDA account isn’t just a debit target—it’s your money’s best buddy! Demand deposit accounts let you withdraw anytime, no notice, unlike locked savings. Personal ones for daily spending; business DDA account types handle payrolls.

Perks? Free checks, debit cards, online transfers. Vs. term deposits? Those tie up cash for interest; DDA debit meaning stays liquid. DDA deposit vs term deposit: choose DDA for flexibility. Banks love ’em—over 90% of folks use one daily. Master this, and statements become friends, not foes.

FAQs and Next Steps

Got lingering questions? We’ve woven in long-tails like why does DDA debit appear and “DDA debit fee explained. Quick hits:

- DDA account types? Checking, NOW accounts—easy access kings.

- Unrecognized DDA debit on statement UK? Check emails; call bank.

- Cancel DDA authorization bank? 3 steps: log in, find, zap it!

- How to stop DDA debit charges? Revoke permission pronto.

Next steps: Download your bank’s app for alerts. Review statements weekly—takes 5 minutes, saves hundreds. Set up spending buckets to dodge overdrafts. You’re armed now—wave goodbye to DDA debit dread. Share this with a friend; spread the calm!