There’s no doubt that the UK has evolved from a manufacturing-based industry to one that’s predominantly reliant on services in the last 50 years or so, becoming the de facto financial capital of the world in the process.

This change has led to London becoming the financial center of Europe and even competing with the stock exchanges of Wall Street, New York, and Shanghai, China.

In 2021, for example, the region’s financial services sector contributed £173.6 billion to the UK economy, with this representing some 8.3% of the total economic output and making it a vital part of the economy and a source of funding for public services such as policing and the NHS.

At the heart of this is a continuously improving new form of finance called fintech, which is progressively reshaping the industry and its advancement.

But how exactly is fintech achieving this aim?

What is Fintech?

The term ‘fintech’ refers to the integration of technology into various financial services offerings and companies, with a view to driving improved financial services for people, organizations, and governments across the world.

This is done through the use of information technology, where important data can be safely and seamlessly stored and used to make transactions while being recorded.

In simple terms, it works by unbundling its array of offerings from one business to another, allowing for fintech to impact across a much broader range of markets and applications.

Fintech and its startups are inherently disruptive, as they look to challenge established processes and players in the financial services space and prioritize inclusion over mere profitability. This will undoubtedly put pressure on the banking industry to improve or change its business model over time.

By slashing operational costs too and adopting more and more automation, business model firms are well able to compete more aggressively with established financial firms and claim a larger share of the market overall.

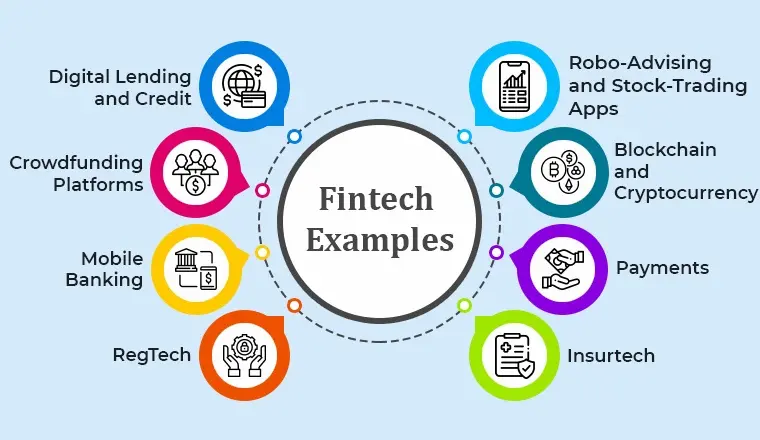

What are the Prime Examples of Fintech?

There are multiple examples of fintech in action, including the relatively old and now-established crowding funding platforms available online. The main and most obvious example is online banking, which has completely changed the way people handle their finances.

Gone are the days of using cheques or cash to receive a monthly salary. Now, people can automate their finances by receiving their salary and then automatically paying for their expenses using direct debit.

The evolution of mobile payments has also been marked throughout the fintech age, with Statista now revealing that the global mobile payment market has recently surpassed $1 trillion.

Mobile payments represent the pinnacle of advanced technologies in fintech and smartphone evolution, enabling users to now transact and exchange money, securely online, in real-time, and through the use of mobile apps.

Fintech has also seen the rise of mobile CFD trading and similar investment vehicles, while automated FX robots and predictive learning are also enabling traders to optimize profit and minimize the risk of human error.

Perhaps the best-known iteration of fintech is blockchain and cryptocurrencies, the former of which underpins the latter and has created an entire ecosystem of digital currencies.

These are also driving financial inclusion in the developing world and regions like Africa, despite the volatility and ongoing controversy that surrounds them, the blockchain technology that underpins cryptocurrencies can really help improve and speed up the cross-border trading process.

The Pros and Cons of Fintech

Before we go, it’s important to consider the pros and cons of fintech. Certainly, this technology has improved financial inclusion through decentralized crypto and mobile payment platforms, while making it cheaper and easier for customers to transact with one another as well as saving considerable time and effort compared to old banking methods.

As such, fintech has made online banking easier and more accessible across the board, while the most recent stage of this evolution has seen major financial institutions adopt and integrate fintech services into their operation.

Conversely, the increase in automation that fintech brings has led to initial job losses and a restructuring of the labor market as technology increasingly replaces and automates simple tasks.

There’s an argument to be had that this will further propagate financial inequality across the societies that adopt these technologies, while it’s also increasingly hard to regulate across the globe, due to different financial regulatory rules in different jurisdictions.

These changes are evolutionary and likely to lead to overall improvements over time, but they’re undoubtedly disruptive in the shorter term and will require careful regulatory oversight to safeguard citizens from any potential downsides they could cause.